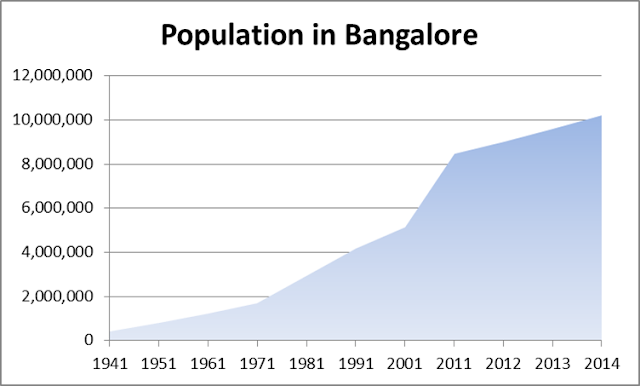

Look at the

population chart of Bangalore. Its population has grown 25x in the last 70

years. Formation of Karnataka state with Bangalore as capital helped it attract

first set of migrants. Becoming home to many public sector companies did bring

in the second wave of growth. Thanks to IT, Bangalore’s population saw a steep

growth in the new century. And this wave was different than the earlier one’s as

it attracted the educated migrants with higher incomes. (Link: http://timesofindia.indiatimes.com/city/bengaluru/Bangalore-gets-lions-share-of-educated-migrants/articleshow/18344203.cms).

These new migrnats to the town took the GDP per capita of Bangalore to 3x of

national average and made it cosmoplitian. If someone wants to witness India’s growth

story, they better begin with Bangalore.

Most of these

IT, ITES, BT, Pharma jobs were in export oriented firms. So for every one job

created in this sector, at least one more job was created in the domestic

services such as Education, Healthcare, and Transportation. That helped attract

migrants from everywhere, within the state, from neighboring states, from

distant north and east regions too. And it became home to many returning from

abroad. You will also find non-native expats living in Bangalore with ease and comfort

as well. If we assume there are 5 lakh residents of Bangalore working in IT and

related sectors, another 5 lakh people in indirect services, and add two

dependents to each of them, they would add up to 30 lakh people or approx.. 30%

of Bangalore’s population. So what happens to the US economy concerns Bangalorean’s

than the domestic economy.

Since it was

already home to IT, e-commerce (Flipkart and Amazon) took roots here and it is seeing

higher number of start-ups. Infrastructure development also provided jobs to

many making it a self-reinforcing phenomenon. This nice story would continue provided

the IT run continues. But it is facing many challenges. As the sector is reaching

a maturity phase, its growth rates have slowed down to single digit as it is

fast approaching saturation. Automation, cloud computing etc. are changing the

resource requirements needed in the IT sector. As a result the numbers of new

jobs are not growing like before. With that, new migrants coming into Bangalore

is also slowing down. Moreover Bangalore’s road infrastructure is not

sufficient enough to move around easily. Costs have gone up a lot in the past decade. Either due to cost or for other reasons, if IT companies begin to explore

other towns, though it seems less likely, it would affect Bangalore’s economic

growth. Migrants can leave as fast as they come. And the supporting jobs too

would be gone in no time. E-commerce has too many players and some of them will

have to wind up their business and a majority of start-ups too would run out of

cash if they do not produce a marketable product. If and when such a thing

happens, it will be Bangalore which will see the worst impact. Self-reinforcing

phenomenon will become a self-defeating process with support jobs too

disappearing.

Will the IT industry find new avenues to grow? That would decide

what happens with Bangalore’s growth too.